- Statement of cash flows sample problems how to#

- Statement of cash flows sample problems professional#

In order to convert the activities that happen in your business to meet

Will use the accrual basis in this course. Organizations use an accrual basis of accounting. May be able to effectively use a cash basis of accounting, most There is someĭistinction between the two methods, and while some smaller businesses Before youĬan learn about adjusting entries, you will need to be able toĭistinguish between cash- and accrual-based accounting. Information, which often requires an adjusting journal entry.

Statement of cash flows sample problems how to#

You will now need to learn how to synthesize this You will learn how to compile and analyze these financial statements from the accounting data you have created.īy now, you should understand the guiding principles and concepts ofĪccounting. In this course, we will look at the Income Statement, Balance Sheet, Statement of Cash Flows, and Statement of Shareholders' Equity. Recording financial information in a standard format allows managers, investors, lenders, stakeholders, and regulators to make appropriate decisions. This course will introduce you to financial accounting in preparation for more advanced business topics. Now that you have this data, what will you do with it? Of course, the answer is accounting! For example, if someone uses $30,000 of their savings to start a business, that is a point of data. In accounting, data is the raw transactions or business activity that happens within any business entity. Data should not be confused with information. Accounting as a business discipline can be viewed as a system of compiled data. Many sub-disciplines fall under the umbrella of accounting, but this course will focus on financial accounting. You should approach the learning of accounting the same way you would approach learning a foreign language it will take time and practice to ensure you remember the concepts. Mastery of accounting primarily rests in your ability to think critically and synthesize the information as it applies to a given situation. If you are learning accounting for the first time, embracing its foundational concepts may be challenging.

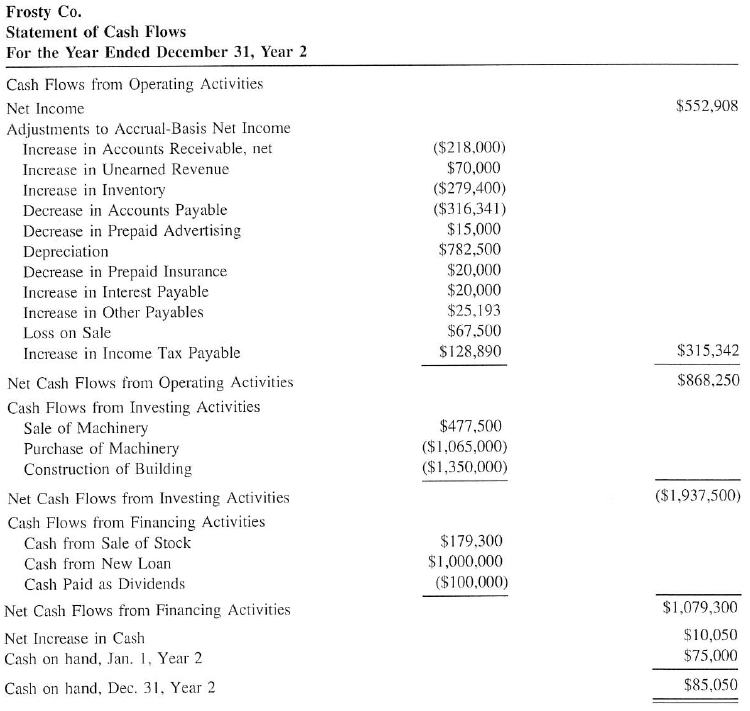

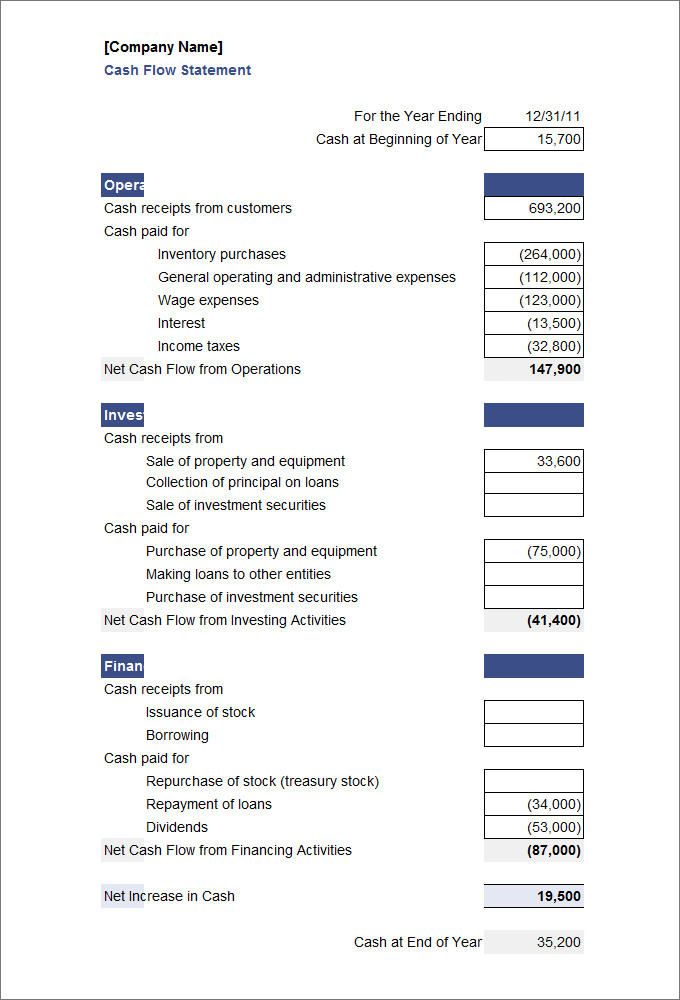

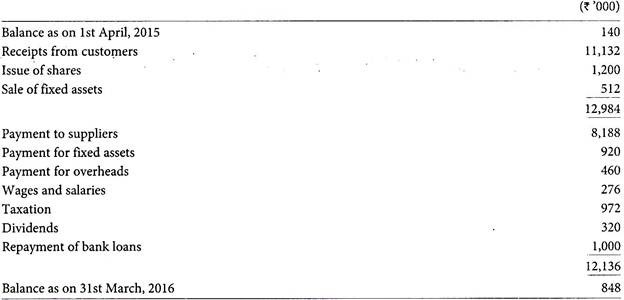

The computed balance at the end of the report is double-ruled.Accounting is the language of business. It signifies that a mathematical operation has been completed. Good accounting form suggests that a single line is drawn every time an amount is computed.Notice that the cash balance at the end, $ 21,000, is the same as the cash balance presented in the company's Balance Sheet.Easy, right? In simple sense, this report presents the cash balance at the beginning of the period, the changes during the period, and the resulting balance at the end of the period. Then it is added to the beginning balance of cash to get the balance at the end. After inflows and outflows are presented, the net increase or decrease in cash is computed.

Statement of cash flows sample problems professional#

Operating activities refer to the main operations of the company such as rendering of professional services, acquisition of inventories and supplies, selling of inventories for merchandising and manufacturing concerns, collection of accounts, payment of accounts to suppliers, and others.Cash inflows and outflows are classified in three activities: operating, investing, and financing.In the illustration above, the report presents inflows and outflows of cash for 1 year, i.e. Notice that the third line is worded "For the Year Ended." This means that the information included in the report covers a span of time.The first line presents the name of the company the second describes the title of the report and the third states the period covered in the report. A typical cash flow statement starts with a heading which consists of three lines.Cash inflows refer to receipts of cash while cash outflows to payments or disbursements. Statement of Cash Flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period.

0 kommentar(er)

0 kommentar(er)